Irs Pub 535 2024 – J an. 1—The Internal Revenue Service (IRS) has announced changes to the 2024 tax brackets as part of its annual adjustments in response to inflation. As highlighted by the IRS, the tax year 2024 . Professor Natasha Sarin, Mark Mazur, and Robert Goulder discuss the effect the IRS’s funding from the Inflation Reduction Act will have on tax revenue and compliance. .

Irs Pub 535 2024

Source : ramp.comMileage Log IRS Publication 535 2023 Standard Mileage Rates 65.5Ȼ

Source : www.instagram.comA Small Business Guide to IRS Publication 535 in 2024

Source : ramp.comNew Rochelle Chamber (@newrochamber) • Instagram photos and videos

Source : www.instagram.comUnderstanding The Needs Of Your Business FasterCapital

Source : fastercapital.comIRS Offers Guidance on Pass Thru Deduction 199A in Publication 535

Source : tehcpa.netCasualty, Disaster, And Theft Losses FasterCapital

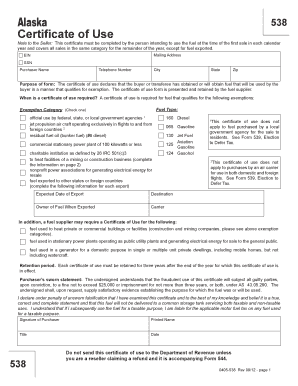

Source : fastercapital.comPublication 535 2012 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comStaying Compliant With Irs Regulations On Qualified Dividends

Source : fastercapital.comIRS Publication 535 Business Expenses | PDF | Expense | Tax Deduction

Source : www.scribd.comIrs Pub 535 2024 A Small Business Guide to IRS Publication 535 in 2024: The IRS has announced new income tax brackets for 2024. The IRS issued a press release describing the 2024 tax year adjustments that will apply to income tax returns filed in 2025. Standard . In other words, someone with $100,000 in taxable income in 2024 would fall into the 22% bracket, but would owe a tax bill far below $22,000. Tax years can get confusing. The changes the IRS .

]]>